From the Founder – Edmund:

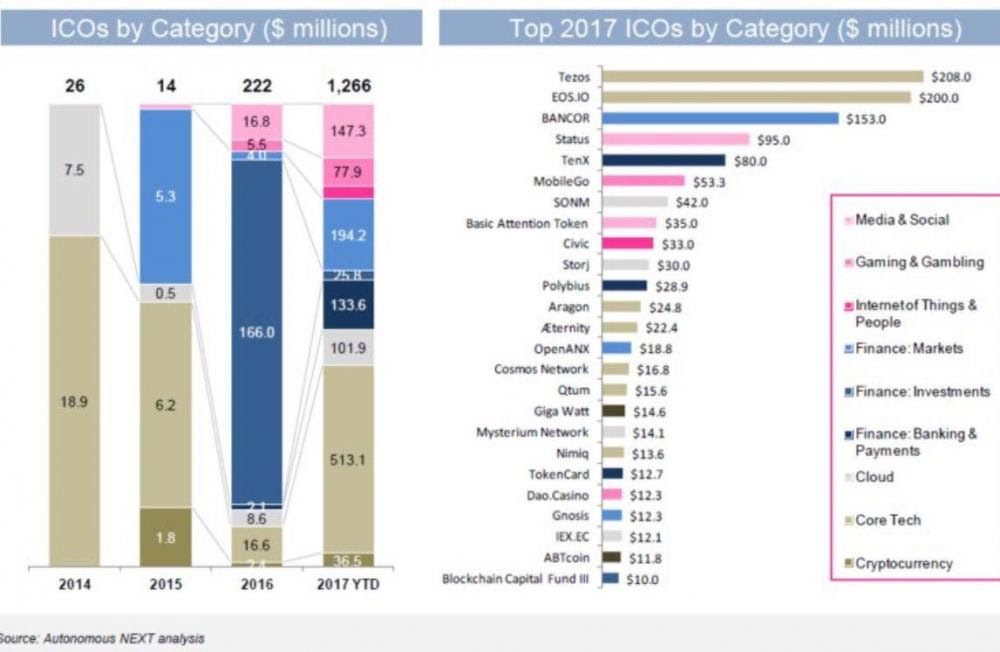

The ICO madness continues…Hi, I wish I could write about something else! I really do! But we saw another record smashed yesterday in the ICO space. Tezos raised a total of $232 million. If you ask me the reason why? Well they had some very strong advisors and a team, and were working on a totally new blockchain for a few years now (according to them). They utilized a typical structure of a issuing company in a Swiss Foundation which acquired 100% of operating entity shares post ICO. Very impressive to be able to raise that kind of money. I have an upcoming article I’m writing on how to structure an ICO and where to set it up. We are seeing many other industries besides just blockchain core tech be funded as well. See this chart which shows in 2013 it was mostly core tech being funded, but now there are categories from media or IOT to gaming. Overall ICO’s aren’t completely new but the rate at which they are receiving funding is unprecedented. This is partly because there are so many new entrants into the space, partly because the technology is maturing, and partly because there are new investors buying ethereum (or old investors who have made a killing on ethereum and are now investing again). As mentioned in a newsletter last week – JPY/BTC now represents the largest trading volume of any currency pair. We’ve been getting inundated with ICO inquiries here at FlagTheory and have setup a new product to help entrepreneurs walk the tightrope that is doing an ICO. ICO’s involve a lot of our core strengths at FT. ICO’s use corporate structures that are cross jurisdictional, and involve a lot of core technology to get off the ground. Technology is our dog food. We understand and build technology (software, crypto, ecommerce) If you are interested in doing your own ICO or investing in others, let us know. From Flag Theory: What are the world’s safest banks and how to evaluate themTwo weeks ago, Italian’s government agreed to bail-out (again) Banca Popolare di Vicenza and Veneto Banca with €17 billion. Another case of bank collapse in the EU, and so on and so forth, bailout funds to support to European troubled lenders already account for more than €2 trillion since 2008. Funds financed by ECB’s QE bonds purchasing program and a zero-interest policy, penalizing responsible savers, encouraging asset bubbles, and mortgaging the economy and the prosperity of its citizens. In previous newsletters, we reported how creditors and shareholders were obliged to bail-in Spanish Banco Popular. Where, through the European Union Single Resolution Mechanism (SRM), Banco Santander acquired the bank for just €1. These are examples on how fragile and unsafe are banking systems in most western countries. If you deposit all your money in a financially irresponsible bank backed by a bankrupt government, you are taking an unnecessary risk. Consider protecting your savings, depositing them in safe offshore banks with prudent and responsible investment and lending policies, high solvency and liquidity levels, in financially healthy jurisdictions. Make sure that your savings are safe and available for when you need them. This is why we have compiled some useful assessment measures, to evaluate the safety and soundness of a bank, and a review of some of the safest offshore banks worldwide. You can read the full article here. Also, consider investing a portion of your savings in precious metals such as gold or platinum, it was, it is, and it will always be a safe investment to ensure your purchasing power, no matter what happens in the world. And move a small part of your savings outside the financial system, holding cash and investing in digital currency, for what might happen… How world’s best passports holders can reduce their tax liabilityBearing a high-ranked passport, such as the German, Norwegian, Finnish, Canadian, American, Swedish, Korean, Spanish, French, Japanese or British, makes the most impact on your life in terms of where you can travel. Allowing access visa-free or visa-on-arrival to most countries worldwide. But usually, these tier-1 passports come with high tax liability. Here, we try to convince you how adopting Flag Theory’s internationalization strategies may lead you to legally minimize your tax bill and double your earnings, while benefiting from the mentioned great travel mobility. Building your life internationally not only will enhance your finances, it will also open a myriad of opportunities and lead you to live experiences to grow both personally and professionally. There is no one-size-fits-all solution for everybody, as several factors such as nationality, type of business, source of income, corporate tax-residency, employees and clients location, existence of tax treaties, among others, must be considered when designing an internationalization strategy. At Flag Theory, we are ready to offer you a tailored integral solution, including residency, incorporation and banking, according to your needs and priorities for your specific personal situation and business. Apply for a free 30-minute consultation and start your journey towards more freedom, privacy and wealth. |